Is it easy to invest via Momentum?

Clearly not, there is no easy and high-performing investment, and the Momentum strategy is no exception.

Ego vs. Algo

As mentioned earlier, investing through a Momentum strategy means entering positions too late when buying (after a minimum increase has occurred) and selling too late (once the increase has ended).

For example, the Spanish stock ROVI, bought at the end of December 2023 as part of the 5-stock Europe portfolio and sold at the end of August 2024, generated a profit of more than 30%, which seems quite interesting at first glance.

But if we take a closer look by graphing the price movement in hindsight, we could think that this investment started too late and ended too late.

Indeed, the ideal would have been to buy at the beginning of November and sell at the end of May, which would have resulted in about 80% increase over 6 months, compared to just a 30% increase over 8 months here.

This is the dilemma of investing via a Momentum strategy: it’s easy, effective, but terribly painful for the ego, especially when you look at the historical price charts and ask yourself the terrible question, "What if...?" Our ego (at least mine) thinking it’s smarter than average will want to buy or sell a little earlier, sometimes it works, sometimes it doesn’t, and the time spent managing the portfolio grows when the goal was to spend as little time as possible, avoiding any emotions.

The Momentum Casino

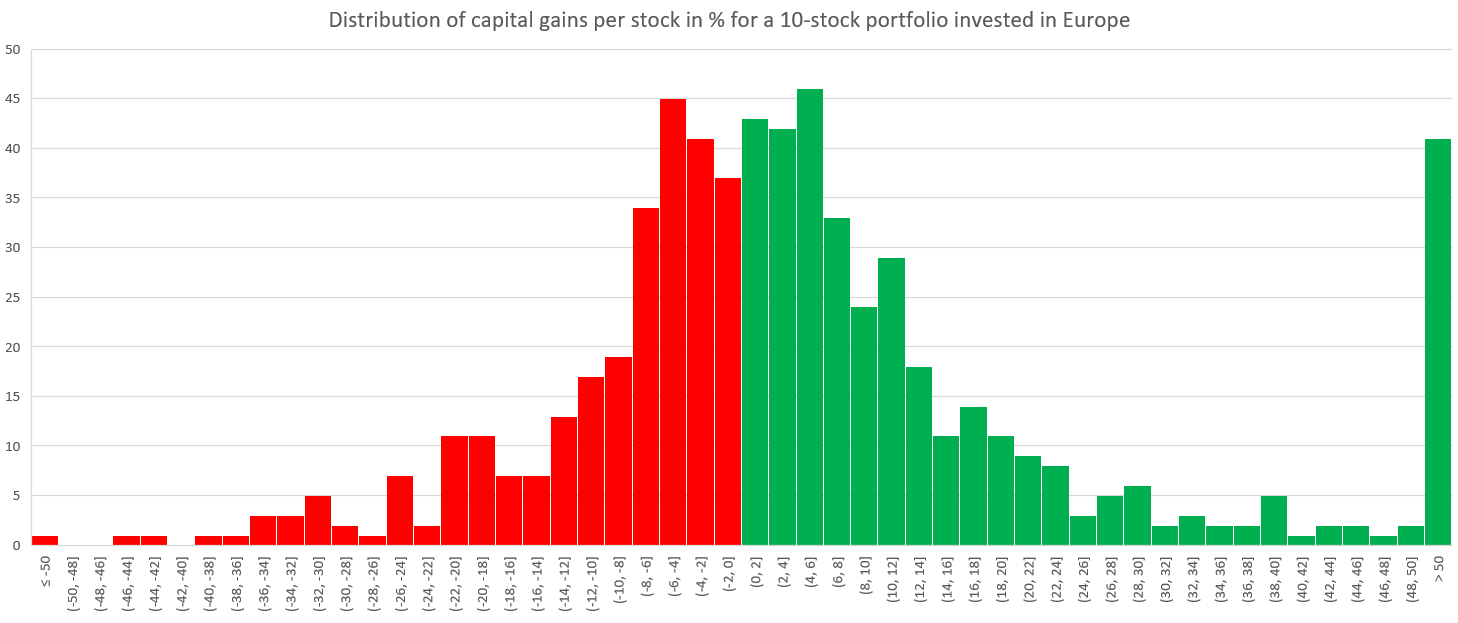

Moreover, investing via Momentum means making significant gains and moderate losses at the same time. If we plot the gains (in green) or losses (in red) on the x-axis, and the number of monthly gains or losses between 0% and 2% for example (43 gains in this case), we get the following chart:

What you need to understand about this chart is that it’s impossible to avoid losses (in red). I don’t have a solution to avoid them, and wanting to achieve a good performance requires accepting both gains AND losses!

Looking at this chart, we can see around 40 sold stocks with a 50% gain or more (up to 600% for one of them), and only 2 sold stocks with a -50% loss. We also have 28 sold stocks between 10% and 12%, and 17 sold stocks between -10% and -12%.

In practice, you will regularly find a Momentum portfolio where the sold stocks are +5% or -10%, and the stocks still in the portfolio are +50% or +100%. Sometimes, we buy before an increase due to good results, or sell due to poor results, without predicting each variation individually.

The algorithm acts like a filter that tests many values, without knowing in advance which ones will outperform, then keeps the best ones in the portfolio as long as possible, removing others as soon as they show signs of weakness. Without emotions.

This is why I titled it this way: investing in Momentum means going into a casino with, for example, 20 roulette tables (representing the 20 stocks you are betting on), and for each table, choosing a color (red), knowing that these roulette tables have far more red slots than black ones. If you bet on red across these 20 tables, the risk is diluted—there will be losses, but they will be diluted by much larger gains.

However, if you diversify enough and remain patient and disciplined, these losses will be much smaller than the gains, and you will end up winning, at the cost of volatility.

Everything is a matter of discipline!

Monthly Rebalancing

Another downside, this investment method requires rebalancing every month, but it’s limited, with on average 25% of the stocks being sold and repurchased. I will discuss this in more detail in a later chapter.

So no, it’s not the easiest investment method. If you want to simplify your life to the maximum, you’d rather go for an investment fund like Berkshire Hathaway, which has proven its relevance for decades.

But as with everything, it’s a matter of compromise between performance, risk, and time spent.

Next article: What is the risk?