Monthly Rebalancing

Here is the final part, how to perform the rebalancing each month. As mentioned earlier, it is crucial to prioritize taxation, so using specific envelopes related to your country. To simplify the process, I use an Excel file with a tab for each portfolio.

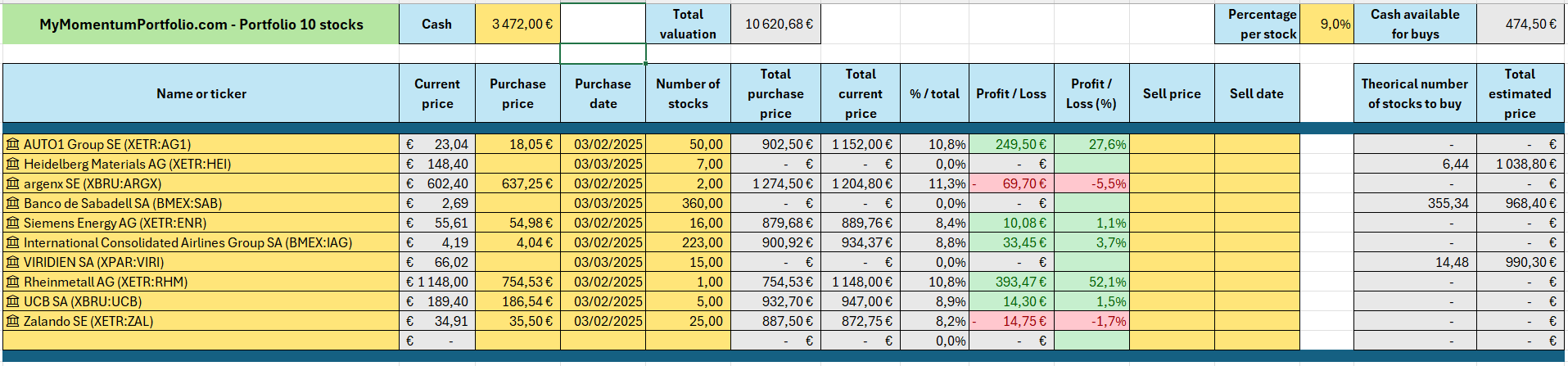

Here is an example of a portfolio invested in Europe in 10 stocks on 03/02/2025, then rebalanced on 03/03/2025 (one month later).

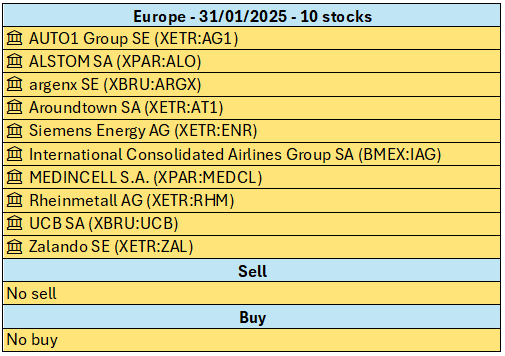

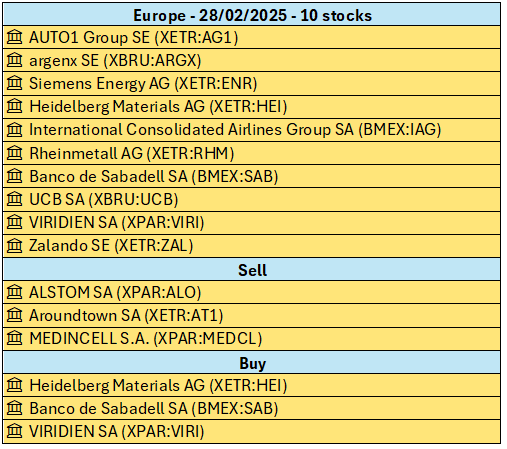

For reference, the portfolio was structured as follows (left column) on 31/01/2025:

I use the following Excel file available for download:

In this Excel file, the only cells to modify are in orange. You can also add or delete rows of stocks as needed if the portfolio is larger. The price is updated automatically, based on the stock name with its ticker. Simply type the ticker in the "Name or Ticker" column, for example, XPAR:STLAP for Stellantis. Sometimes it may not be automatically found if there is a typo; in this case, a data selector will appear on the right, allowing you to select the correct value. If the stock has been deleted, you’ll need to select it and click "Data > Convert to stock data."

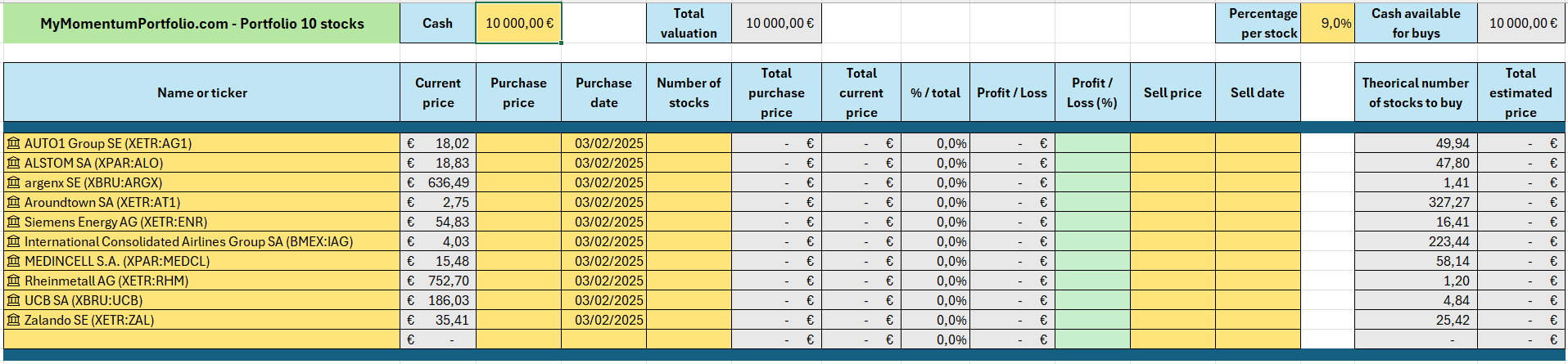

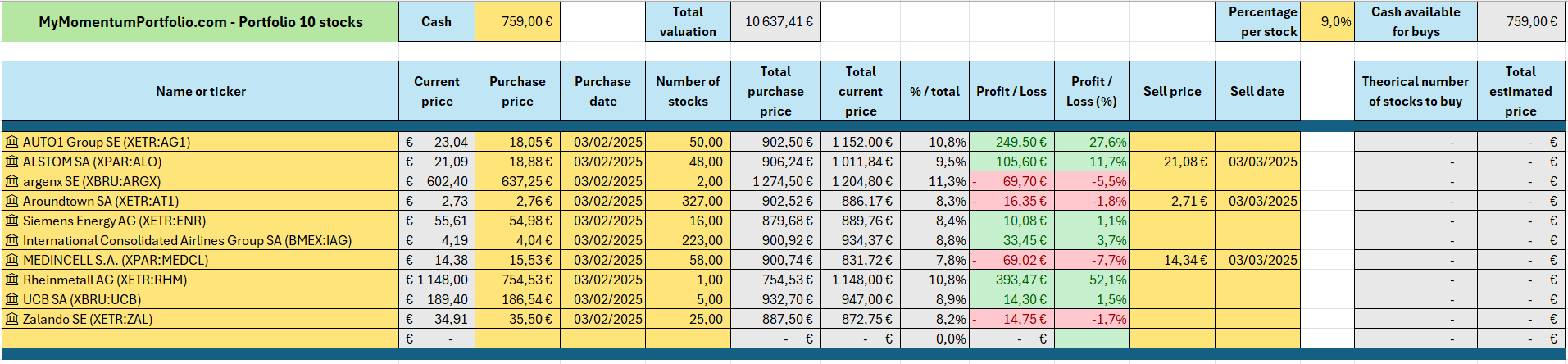

So, I have the following setup before the initial purchase:

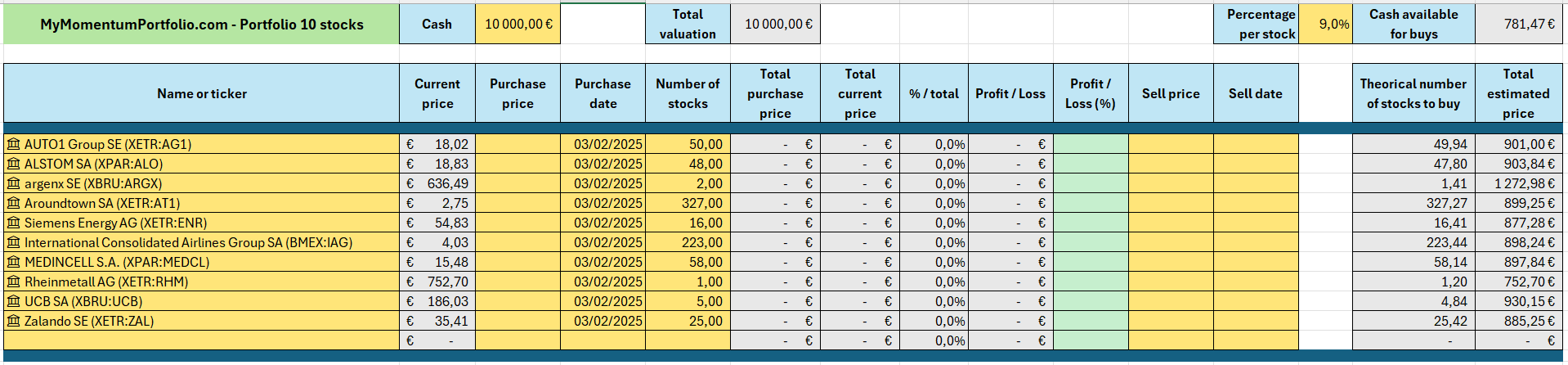

The portfolio is valued at €10,000 before rebalancing, and all the stocks to buy are entered. Then, I need to copy the number of stocks to buy from the "Theoretical number of stocks to buy" column. I can also adjust the "Percentage per stock" to have a different percentage (around 9% here, so €900 per stock, as you need to leave some margin in practice).

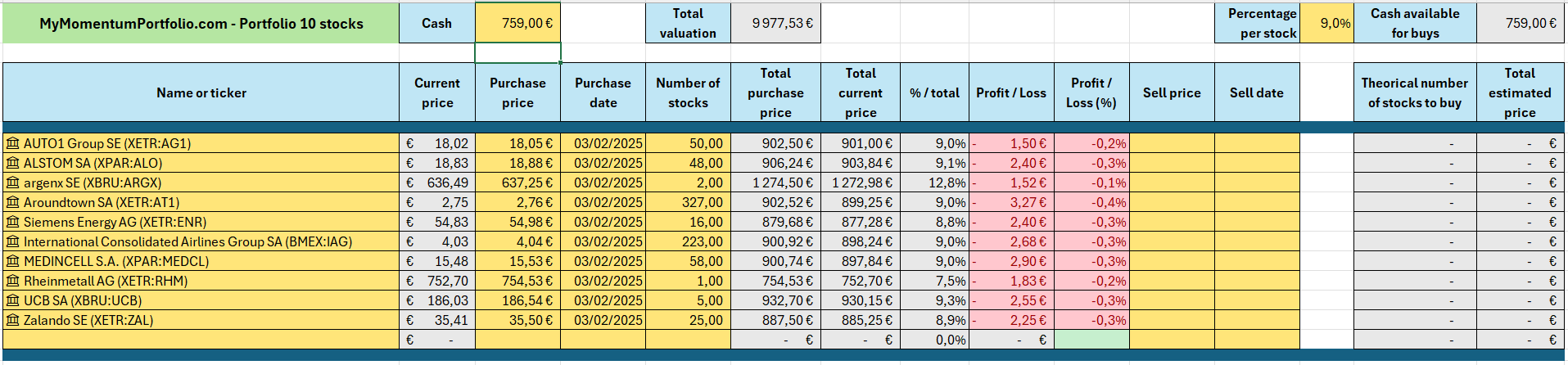

Finally, I can buy the stocks, report the unit purchase price, and the remaining cash.

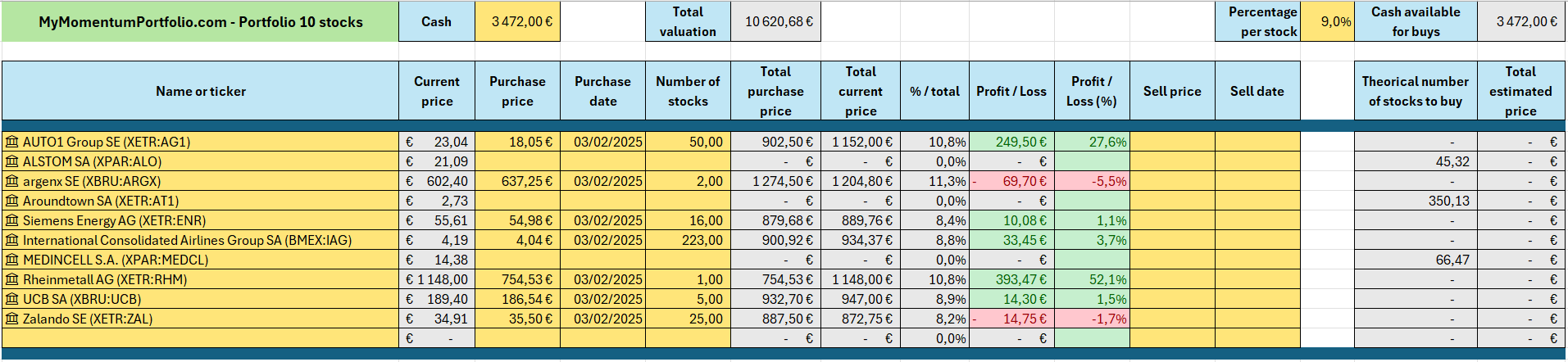

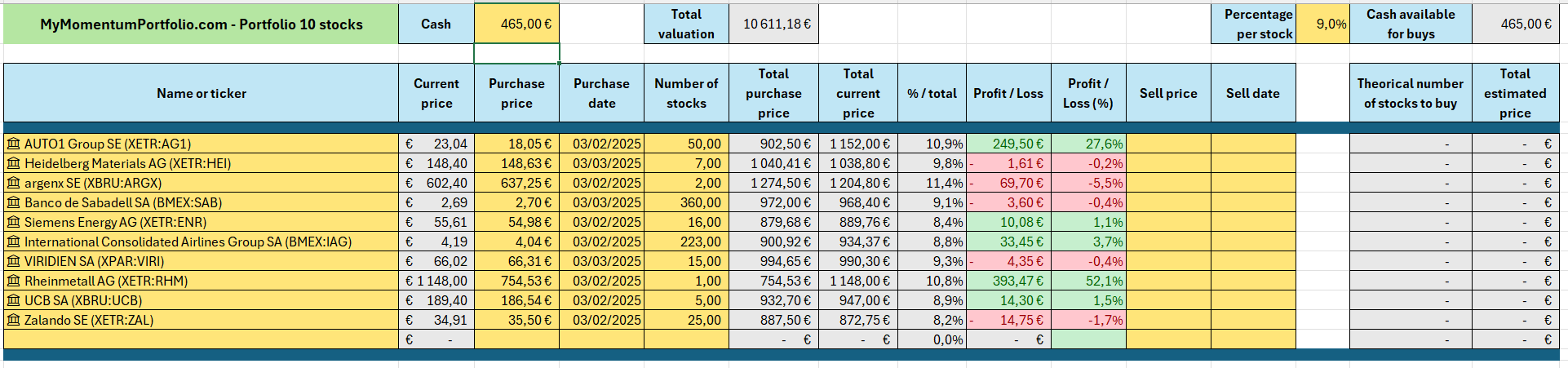

Then, one month later, here is the new rebalancing on 28/02/2025:

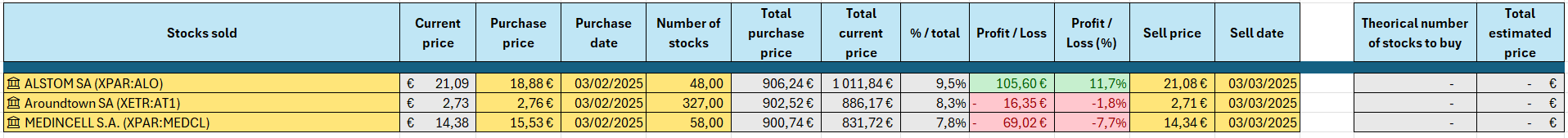

I will sell the Alstom, Aroundtown, and Medincell stocks and indicate their unit sale price:

Then, I copy-paste these lines below to keep a record. Finally, I remove their purchase price, sale price, number of shares, and the purchase/sale date, as well as the available cash.

Next, I add the desired stocks (Heidelberg, Sabadell, and Viridien) and adjust the number of shares to the number proposed on the right. I can leave the number of shares and the purchase price at 0 if no purchase is desired.

Finally, once I am satisfied with the new rebalancing, I can buy the desired amount of stocks via my broker, update the available liquidity, and the actual purchase price of my stocks.

Everyone can have fun modifying this file according to their preferences, changing the colors, etc.

We also notice that I didn’t sell part of stocks like Auto1 Group or Rheinmetall, which represent almost 11% of the portfolio instead of the target of 9 to 10%. In fact, it is preferable to limit brokerage fees and also to focus on the highest-performing stocks. This is the whole principle of Momentum, and in my opinion, it's ideal: “Keep the winners, sell the losers.” However, one could sell part of a significant position if desired to match the backtest as closely as possible. Indeed, the backtest assumes all positions are of equal weight in the portfolio (10% each if 10 stocks), to simplify the calculations.

Finally, one can also make exceptions by avoiding certain stocks (like Thales if you want to avoid defense industry stocks, for example) and selecting a stock from another portfolio, hence my desire to provide portfolios of 5 to 20 stocks, even if the latter doesn’t bring much additional volatility reduction compared to the 15-stock portfolio.

Next article: Conclusion