Performance of an individual stock

If you are wondering what performance a stock is likely to have individually within the portfolio, and how it will generally evolve, this page will give you an overview.

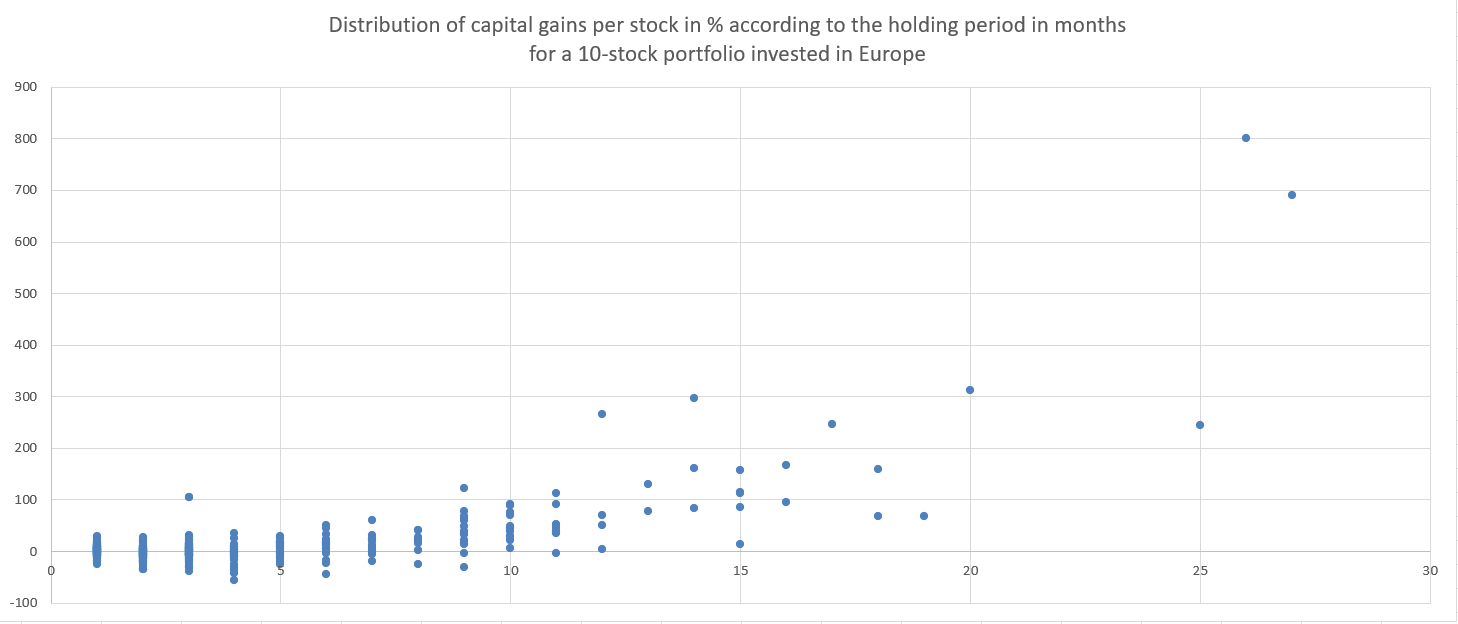

With the algorithm, we can easily plot a graph in the form of a scatter plot (a scatter of over 600 points, corresponding to more than 600 sales for the portfolio in question over 20 years). Here is the result for a portfolio of 10 stocks invested in Europe over 20 years (holding period in months on the x-axis, and performance in % on the y-axis):

We observe the following:

- A significant portion of stocks with gains between -50% and +50% with a holding period of 1 to 5 months.

- A significant portion of stocks with gains between -20% and +50% with a holding period of 5 to 10 months.

- A moderate portion of stocks with gains between 0% and +300% with a holding period of 10 to 20 months.

- A very small portion of stocks with gains of over 300% with a holding period of more than 20 months.

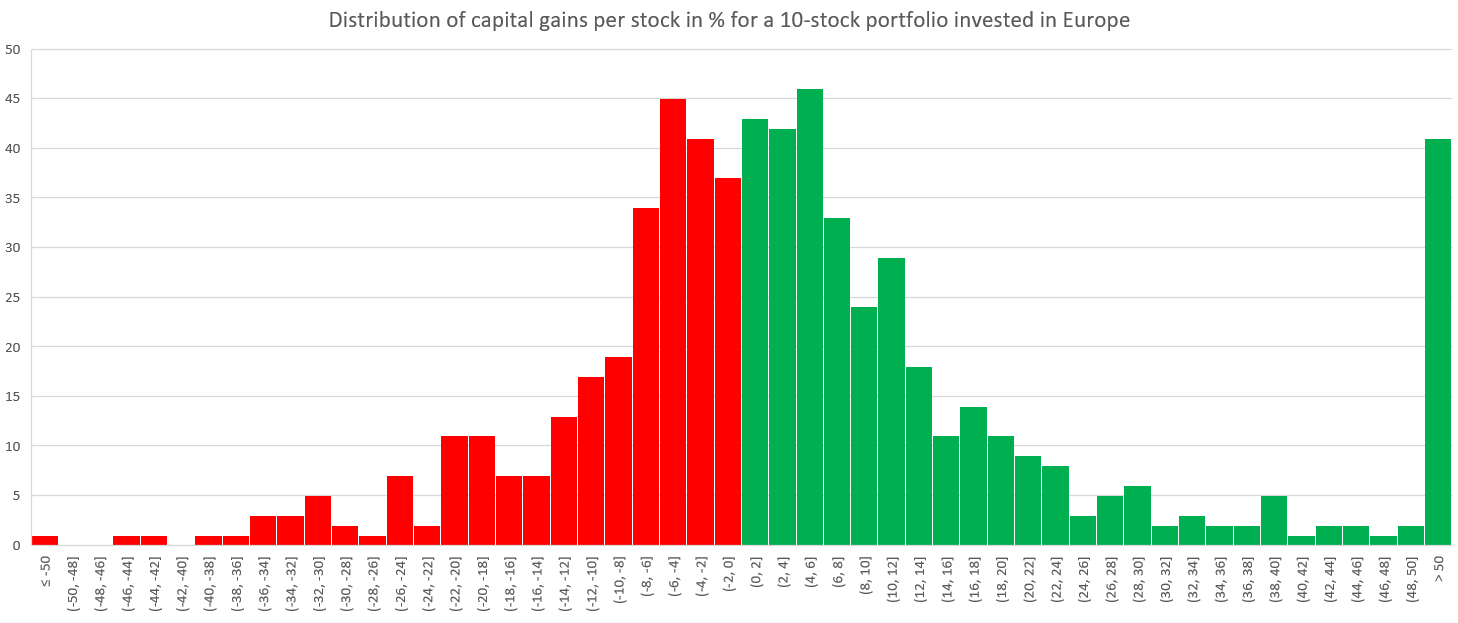

It is possible with the same data (10 stocks invested in Europe) to plot the distribution of gains without considering the holding period, just by adding up all the sales with gains between 0% and 2%, then those between 2% and 4%, etc., and doing the same for sales with losses.

This produces the following graph, with red representing sales at a loss and green representing sales at a gain. Since some of these are very rare but very high, all those below -50% are grouped together (2 sales here), and all those above 50% are also grouped together (the peak to the right in green, around 40 sales).

This illustrates the effectiveness of a Momentum strategy:

- Not being emotional about selling a stock at a loss.

- Focusing on the rising stocks and holding them as long as possible.

In short, we can apply the well-known stock market saying: "Keep the winners, sell the losers"!

Next article: Defining the size of your portfolio