What is Momentum?

Momentum can be described as the velocity of a stock, its tendency to appreciate upward. The more a stock rises, the more people become interested in it, the more people buy it, and the higher the stock price goes, and so on.

The simplified strategy is to buy the stocks that have performed the best in the last few months and sell the others or at least avoid taking positions in them.

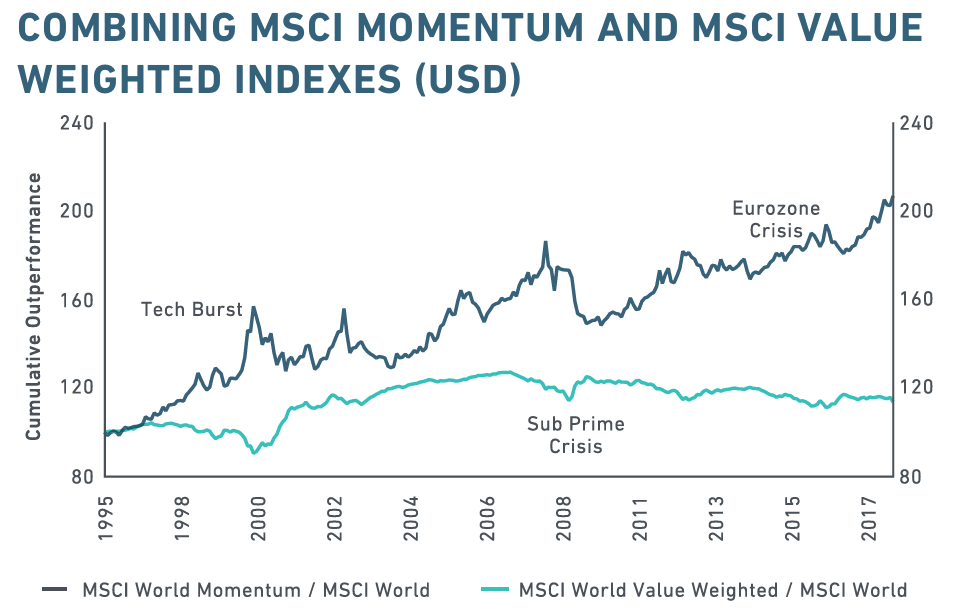

Different studies document this market anomaly, including this comparison between the MSCI World and the MSCI World Momentum.

It shows the outperformance of a fund (ETF) invested globally through a Momentum strategy compared to a fund invested globally via a Value strategy.

It thus becomes quite possible to potentially find stocks with the highest upside potential simply by selecting the stocks that have performed the best in recent months, without performing fundamental analysis (market study of the company, its activity, its financials) or technical analysis (looking at charts, indicators, etc.).

Moreover, by entrusting this analysis to an algorithm, we avoid any psychological bias that could influence decision-making, and we minimize the time spent on decision-making, in order to maximize the hourly return (return relative to the time spent).

This strategy has long been part of the tools used by investment funds in addition to fundamental analysis, and I wanted to make this strategy accessible through this site and newsletter, offering different sizes and sectors of portfolios for a flat fee, rather than a percentage of the invested amount, as banks traditionally do.

Classic Strategy and Optimization

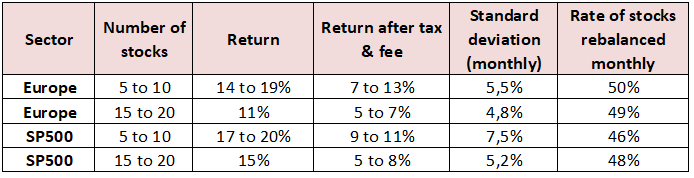

With the classic Momentum strategy based on the performance of the last 3, 6, and 12 months, I obtained the following performance (I will give explanations on volatility and taxes for beginners in the next pages):

A clear improvement in performance is noted compared to a classic strategy of buying an ETF following an index, without Momentum (generally 7 to 10% gross annual performance for the S&P 500, for example, depending on the period).

But the main issue was having 50% of the portfolio impacted by rebalancing, meaning that for a portfolio of 10 stocks, 5 of them were sold after one month. A stock in the portfolio had an average lifespan of 2 months, which led to numerous fees and taxes and impacted the final performance, in addition to creating extra work.

One could argue that with online brokers, very low fees are possible, and that’s true, but these are typically placed on taxable accounts and not on tax-advantaged accounts so the low fees are offset by the taxes paid each year on capital gains. For reference, the table above is calculated with an account having a fee of 0.05% per order, typically €2 for an order of €5000.

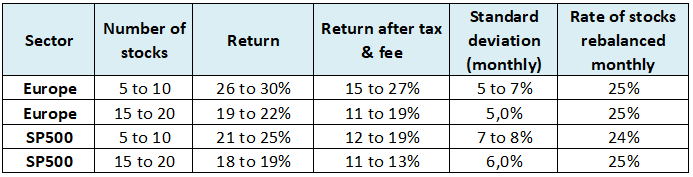

In comparison, here’s a summary of the performance I’ve been able to achieve through the algorithm at MyMomentumPortfolio.com (I will provide more detailed numbers and charts in the next pages):

According to my backtests, only 25% of the portfolio is rebalanced each month, which means a stock stays in the portfolio for about 4 months. The gross performance is improved, the after-tax and fee performance is also improved, the volatility increases a little but marginally, in short, a strategy that gives me complete satisfaction!

Next article: Algorithm & Backtest